Working Capital Solutions

Tailored Working Capital Support for Your Business

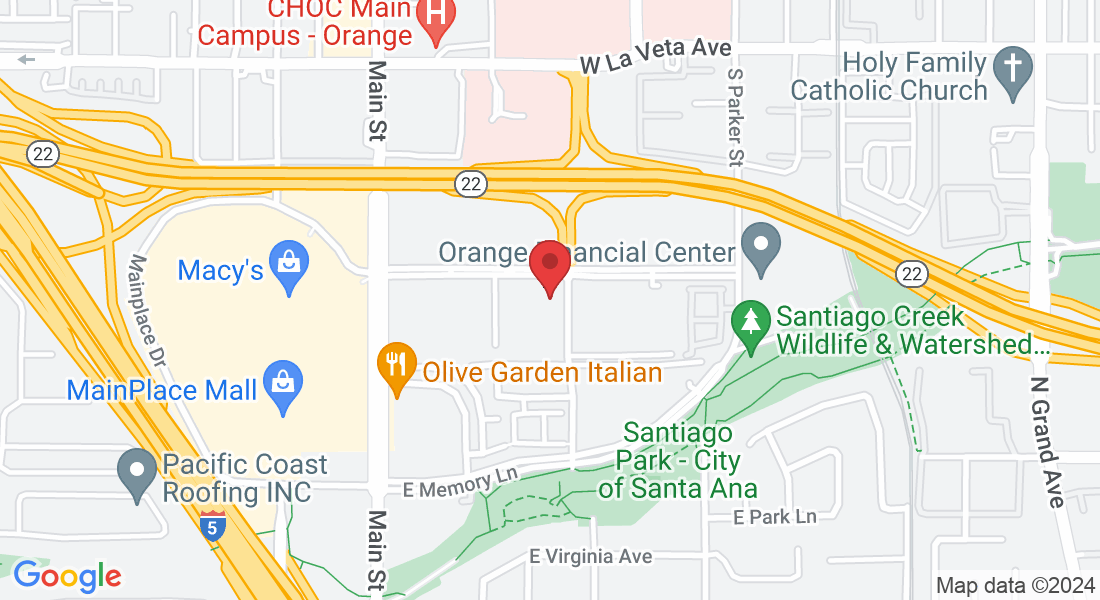

HOW WE WORK

Business Funding

UNSECURED FUNDING

This business loan option for working capital accommodates FICO scores as low as 550. Offering flexible terms ranging from 12 to 84 months. To qualify, businesses should have a minimum of 1 year in operation and demonstrate an annual revenue of at least $300,000.

HOW TO QUALIFY

4 year time in business +$350,000 Annual Revenue

No open judgments, liens, or defaults

BENEFITS

Monthly Payments No Prepayment Penalty Up to 7-Year Terms Unsecured & Secured Options

24-48 HR FUNDING

Experience an expedited process from application to funding in as little as 48 hours! Benefit from industry-leading terms and the lowest rates available for your financial needs.

SECURED FUNDING

Explore a range of business loan options leveraging your assets, including equipment, technology, or real estate equity. Call today to discover the diverse financing possibilities available for your business needs.

PROCESSING TIME

Secure working capital swiftly through our specialized loans. Equipment equity loans typically take 4-7 business days, while real estate loans typically require 4-5 weeks. In certain instances, faster processing may be possible. For more details, consult your account manager today.

COST

MCA Cost reduction by 70%Consolidate up to 7 Position

The main difference between secured and unsecured?

funding lies in the presence or absence of collateral

Secured Funding

Collateral: Secured funding requires the borrower to provide collateral, which is an asset (such as real estate, equipment, or inventory). This collateral serves as a form of security for the lender in case the borrower fails to repay the loan. Enable more creative options for clients finding the right amount and repayment terms under standard business loans.

Risk: The presence of collateral generally lowers the risk for the lender, allowing them to offer more capital, potentially lower interest rates and more favorable terms

Approval: Secured loans are often easier to qualify for, making them accessible to individuals with lower credit scores provided the asset meets the lenders criteria.

Unsecured Funding

Collateral: Unsecured funding does not require collateral. Instead, approval is based on the borrower's credit worthiness and ability to repay the loan.

Risk: Because there is no collateral to secure the loan, unsecured funding is considered riskier for lenders so more attention is paid to monthly cash flow as a consistent barometer of repayment.

Approval: Qualifying for unsecured funding with longer repayment terms can be more challenging if your not working with a partner like Bank Loan Depot that offers conventional options. Like most loan products, a higher credit score and a strong financial history helps expand your options.