Flexible Financing for Long-Term Success

Unleash the Power of Your Business with Tailored Term Loan Solutions

HOW WE WORK

Business Loan

HOW TO QUALIFY

4 year time in business +$350,000 Annual Revenue

No open judgments, liens, or defaults

HOW TO QUALIFY

4 year time in business +$350,000 Annual Revenue

No open judgments, liens, or defaults

BENEFITS

Monthly Payments No Prepayment Penalty Up to 7-Year Terms Unsecured & Secured Options

BENEFITS

Monthly Payments No Prepayment Penalty Up to 7-Year Terms Unsecured & Secured Options

COST

MCA Cost reduction by 70%

Consolidate up to 7 Positions

COST

MCA Cost reduction by 70%Consolidate up to 7 Position

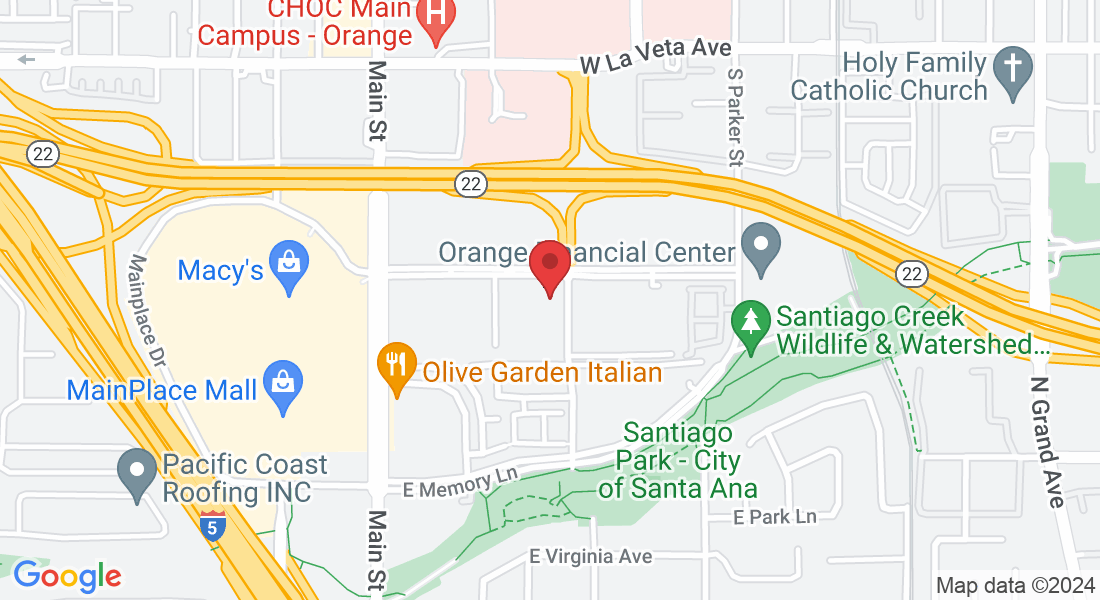

Business Financing is not one size fits all

Every business owner deserves to see all their options

Our most popular program since 2014, with set monthly payments and no prepayment penalty, our Unsecured Business Term Loan was designed to be as flexible as possible.

Your funds can be used for almost any business purpose.

Loan offers up to $1,000,000

4-7 Year Terms Available

Unsecured/No Collateral Required

Good Credit Required

Minimum of $350,000 annual revenue required

Applying has no effect on your credit score, and repaying your loan on time even helps your business build good credit!

The Bank Loan Depot Term Loan Program is ideal for business owners who find it frustrating to navigate the endless applications, offers and short term cash advance options.

At the Bank Loan Depot, you work with one point of contact who processes your business loan from start to finish.

Our team gives you the very best programs & options to enable your team to make the very best decision you can for your success today, tomorrow, and always.

Essential Insights To Consider

Introduction and Purpose

If you're looking for business financing—particularly to purchase or fund a real estate project—you may have come across commercial bridge loans. Bridge loans, however, are a very unique type of short-term financing that function differently from typical business loans

Definition and Function

As we mentioned, commercial bridge loans are a very specific type of financing and differ from other types of loans. Bridge loans—also referred to as bridge financing, swing financing, or gap financing—are used particularly to finance an immediate opportunity, typically in business upfront cost for a project, inventory, or even bad debt refinancing.

Bridging the Gap

As the name implies, commercial bridge loans are used to 'bridge the gap' between a business's current need for financing and a more long-term financing solution like an SBA loan or a bank loan.

Characteristics of Commercial Bridge Loans

When it comes to business bridge loans, you're most often talking about commercial unsecured term loans. In other words, these are loans that are used to finance your capital needs while you're in the process of arranging a long-term form of funding or you simply want a longer amortization without a prepayment penalty

Duration and Collateral

Commercial unsecured bridge loans are short-term or interim financing—terms, therefore, are usually on the shorter side—between 3-5 years where a mortgage is typically 20-30 years. Collateral is usually not necessary, although lenders will consider traditional business loan requirements

Lenders and Rates

Commercial bridge loans can be issued by banks, alternative, online lenders, as well as private lenders, venture capital companies, and sub-corps of your favorite national bank. They can come at rates higher than a mortgage, EIDL, or SBA loan but still very affordable

Use-Cases for Commercial Bridge Loans

How do commercial bridge loans work? This commercial unsecured bridge loan would provide you with the funding to take advantage of the opportunity immediately—and then you would be able to find a more affordable, long-term form of financing or refinance your existing business loan if you feel there is an opportunity for a lower rate and/or longer term.

Examples of Use-Case

For example, say, for instance, a client comes to you with a great project assuming you can provide and support your own payroll, costs and build out till he pays your invoice in 30-90 days. With a commercial bridge loan, you can secure the funds necessary to bid the job and lock in the opportunity without hurting your operating cash flow

Tiding Business Over before Acquisition

Tiding your business over before acquisition: You may take on interim financing, in this case, commercial bridge loan financing, to access capital until the acquisition is complete

Stocking up on Inventory

Finally, one last example of a use-case for commercial bridge loans is for stocking up on inventory. Let's say you come across a huge liquidation sale of inventory that you typically stock—you'll likely want to take advantage of this opportunity to stock inventory at a discounted rate. In this case, you'll need access to a significant amount of capital, and quickly.

What to Look for in a Commercial Bridge Loan

So, if you think a commercial bridge loan might be able to meet your business financing needs, there are a few things you'll want to keep in mind as you start your search

Considerations in a Commercial Bridge Loan

However, with this type of interim financing, you'll likely want to pay attention to two fundamental characteristics in particular: Funding time and Prepayment incentive