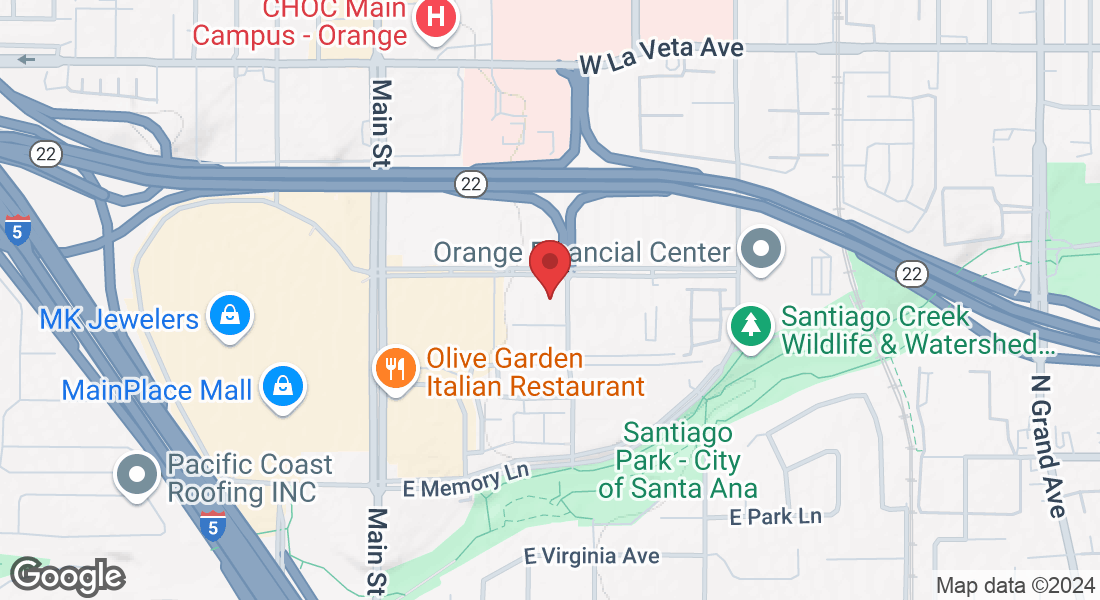

Empower Your Business with Flexible Funding Solutions:

Introducing the Equipment Credit Line

HOW WE WORK

Equipment Funding

APPLICATION ONLY OPTIONS

New and Used Equipment

App only to $250,000

Lease rates as low as 5.99%

24-72 Month Terms

LARGE CAPX REQUEST

$250,000 to 4MM

Equipment Loans, EFA's

Capital Leases & Operating Leases Available

As low as 5.49%

BASIC QUALIFICATIONS

2+ years Time in Business

650 or better Fico Score$

350,000 annual revenue

How our equipment funding works.

Small business equipment loans fund the purchase of a variety of small to large equipment for your business. An equipment loan is typically used by small businesses looking to preserve cash by taking the cost of the equipment and spreading it out over 3-7 years. Equipment loans can be used to replace existing equipment, refinance equipment, or to purchase new equipment as your small business grows.

Typical Equipment Types we have funded:

Vehicles, including semi-trucks, box trucks, and vans. Machinery: Manufacturing equipment, medical equipment, software, restaurant, printers, bulldozers, computer equipment, CNC machines, and construction cement mixers. Medical equipment such as x-ray machines and diagnostic machines.

Equipment Loan Rates, Terms & Qualifications

Loan amounts :$10,000 - $2,000,000 Rates: 4% - 12%Down payment: 5% or less Credit score: 600+ . If you have a credit score above 650 and have money for an initial payment, you may qualify for up to $250K in quick, hassle-free equipment funding.

When to Use a Capital Lease

Small business owners should consider using a capital lease if they will benefit from the flexibility of leasing combined with the benefits of ownership, such as depreciating the asset to offset income and a negotiated purchase price at the end of the lease term. This is ideal for businesses that intend to ultimately purchase the asset.

WHY FINANCE EQUIPMENT

Finance equipment to conserve capital, enabling earlier acquisition of upgrades with larger capacity.

Enjoy the flexibility of monthly payments over 5-7 years, lower payments, and take advantage of tax benefits.

INDUSTRIES WE DO NOT FINANCE

We do not provide financing for industries such as marijuana, at-home child care, adult novelty stores, taxi companies, ride-share operators, and start-ups in any sectors without collateral.

EQUITY CASH OUT OPTIONS

Explore various equity cash-out options that leverage equipment, hardware, and software.

These options can help address credit issues, alleviate cash flow constraints, and tap into additional working capital resources.

Capital vs. Operating Lease

Capital and operating leases are common types of equipment leasing arrangements. A capital lease offers ownership benefits, such as depreciation and a predetermined purchase option, with slightly higher monthly payments. This is suitable for businesses intending to own the asset eventually, especially if the equipment has a long shelf life.

Consider a capital lease when:

1. Your business needs equipment with a long shelf life, like heavy machinery or manufacturing assets.

2. You want to own the equipment at the end of the lease, as capital leases typically include a purchase option.

3. Your business has a high income and can benefit from asset depreciation, as capital leases are considered ownership for tax purposes.

Choosing between a $1 buyout and a 10% buyout depends on monthly payments and preferences. The $1 buyout is suitable for those comfortable with higher payments, eliminating a balloon payment at the end.

On the other hand, an operating lease provides lower monthly payments and flexibility, as ownership is traded for the ability to expense all payments. This option is ideal for businesses looking to maximize tax write-offs, trade for newer equipment more frequently, and avoid long-term ownership commitments.

Consider an operating lease when:

1. You want to maximize tax write-offs on payments for equipment that may not be needed in 4-5 years.

2. Flexibility is crucial, and you want the option to trade for newer equipment regularly.

3. Your business does not intend to keep the asset long term, and you want to avoid potential depreciation challenges in the future.