Empower Your Business with Flexible Funding Solutions:

RE-Introducing the Interest Only Business Credit Line

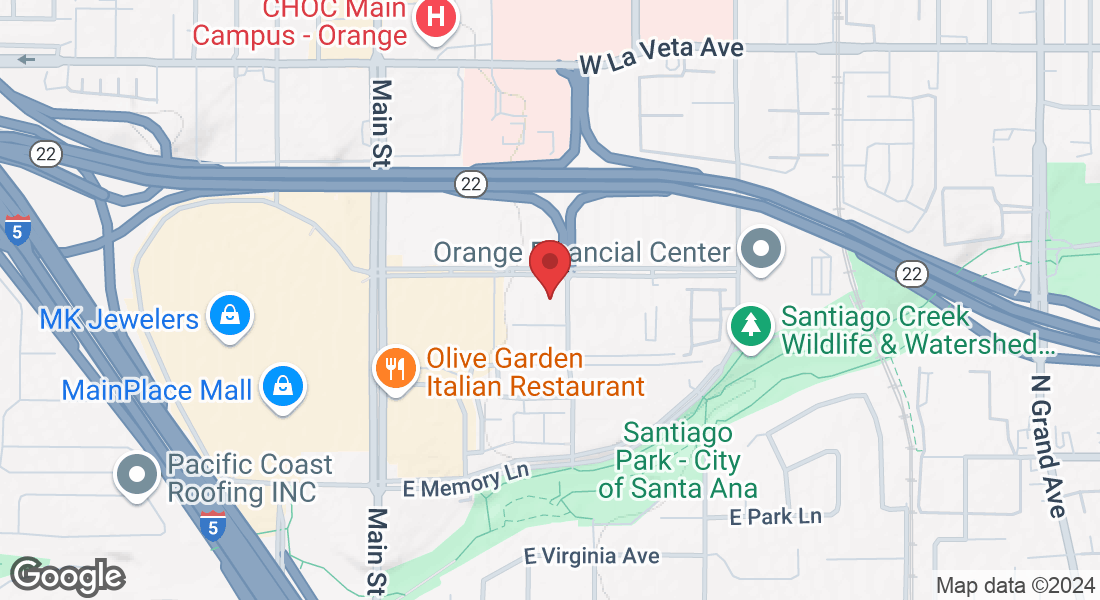

HOW WE WORK

Credit Line Options

INTEREST ONLY LINE OF CREDIT

The provided information outlines a financial arrangement with a rolling amortization period. Rates start at Wall Street Journal Prime Rate plus 1%.

The repayment is structured with monthly payments, utilizing a simple interest model. A modest annual principal reduction is required. A business history of at least 3 years, with an annual revenue of $350,000. The financial product is described as a "True Revolving" mechanism.

REVENUE-BASED CREDIT LINE

This information pertains to a financial arrangement with a 1-2 year term, featuring a monthly interest rate ranging from 1% to 1.5%. The repayment involves monthly payments, and there is no prepayment penalty. To qualify, the borrower should have been in business for at least 2 years, with fair credit quality for ownership. The business should demonstrate an annual revenue of $350,000.

ASSET BASED CREDIT LINE

This financial arrangement spans a 3 to 7 year amortization period, linked to the Wall Street Journal Prime Rate plus 2%.

Repayment involves monthly payments based on a simple interest model. The financing covers up to 75% of the equipment liquidation value. Eligibility criteria include a business history of at least 5 years and an annual revenue of $1,000,000.

How our line of credit works.

Draw funds, make repayments, and replenish your available credit with ease. With

our quick application, you can apply and get a credit decision in minutes.

Limited Paperwork.

A dedicated financial consultant will make the process simple as possible

Flexible payment options.

With terms ranging from 1 year to 10 years, we offer flexible payment options tailored to your needs.

Next Day Funding

After receiving and reviewing your business information, we can swiftly provide you with the funds you need, often in just 24 hours

Lowest Cost

Our team of experts is committed to providing you with the best value. We will provide fast, reliable, and affordable services that meet your business needs