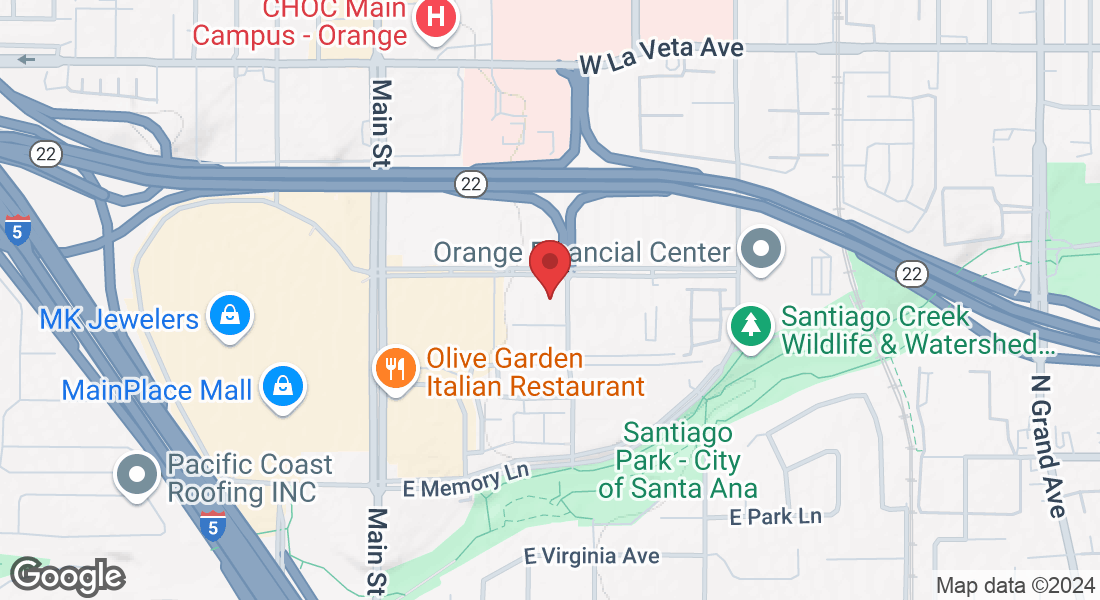

SBA FASTLANE

SBA QUICK FUND UP TO $350,000

HOW IT WORKS

SBA FASTLANE

Application Requirements:

Credit Criteria: FICO score of 685 or higher. Documentation: Application Link, and the last 6 months of bank statements Financial Performance: Last 2 Years of business tax returns with a profit of $1 or more.

Funding Process

Speed: Application-to-funding process can be completed in as little as 15 days. Standard Timeline: Standard funding typically takes 18 business days.

BASIC QUALIFICATIONS

3+ years Time in Business

678 or better Fico Score$

350,000 annual revenue

WHAT DO YOU GET?

33% of your ANNUAL Revenue

10 Year Repayment Term

Monthly Payment

Great SBA Rates

CAP at $350,000

Want to Learn more about SBA Loans

Watch these videos for more information

WHAT IS THE SBA?

ESSENCE OF SBA BUSINESS PLAN

PPP LOAN FORGIVENESS DENIED

Where Passion Meets Process

Why choose Bank Loan Depot for your SBA FAST LANE, 7a, 7a Express, or 504 Funding needs? With over a decade of specialized expertise in SBA 7a, 7a Express, and 504 processing, as well as extensive experience in COVID-19 government consulting, we stand as a reliable partner in your financial journey.

Pre-Qualification Assistance, our experienced SBA team assists you immediately upon filling out the application. We have mastered the process of making business loans quickly. We assist you in preparing and submitting all the necessary documentation required for your SBA Fastlane loan application, minimizing errors and delays.

As a business owner, you need a team with the knowledge and experience not only to understand the intricacies but also to successfully close deals. Our dedicated processing team is equipped to analyze and address challenges. If you've faced a decline, we'll assess the issues and place you with a new lender, ensuring a more suitable application packet.

It's not always your file that poses a problem; common errors or overlooked alternative routes may be hindering your approval and funding. Our team is committed to identifying and rectifying such issues.

Embark on your SBA funding journey with confidence. Contact us today for a complimentary consultation and discover how our expertise and personalized approach can make a difference in securing the financing your business needs."